Ensure FTA-compliant eInvoicing in the UAE with future-ready digital invoicing solutions

Your FTA E-Invoicing, simplified — from compliance to automation, we ensure a smooth experience at every step

A transparent platform to manage E-Invoicing and stay fully compliant with UAE tax requirements

Reduce manual work with smart automation, real-time validation, and error-free invoicing

Generate compliant E-Invoices quickly and securely, aligned with UAE regulations.

Stay fully compliant with UAE FTA regulations through streamlined, automated E Invoicing built for local VAT and business needs.

Ensure 100% compliance with UAE FTA eInvoicing regulations, from VAT reporting to real-time invoice exchange.

Auto-generate VAT-compliant reports and streamline your tax submissions directly aligned with UAE law.

Simplify e‑invoicing with direct integration to UAE-based banks for payment reconciliation and VAT settlements.

Certified for UAE B2B and B2G invoicing networks, including Peppol and FTA exchange mandates.

Prevent rejected invoices with instant detection of VAT or compliance errors before submission to the FTA

Generate bilingual invoices (Arabic-English) as per UAE Ministry of Finance requirements for smoother audits and acceptance.

We will evaluate your system architecture and provide a customized e-invoicing solution to guarantee full FTA compliance.

A fantastic team to collaborate with! They ensured everything was smooth and effortless from start to finish.

Outstanding to collaborate with! They ensured every detail was handled flawlessly, making the entire process smooth and enjoyable.

Working with them was an incredibly enjoyable experience. They made every step of the process easy and stress-free.

Truly a pleasure to partner with! Their professionalism and efficiency made the entire process simple and seamless.

An exceptional team to work with. Their attention to detail and smooth workflow made the experience enjoyable.

A wonderful experience! The team was professional, efficient, and made everything flow effortlessly from beginning to end.

A wonderful experience! The team was professional, efficient, and made everything flow effortlessly from beginning to end.

Truly a pleasure to partner with! Their professionalism and efficiency made the entire process simple and seamless.

A fantastic team to collaborate with! They ensured everything was smooth and effortless from start to finish.

E-invoicing simply means creating and sending invoices digitally—not as paper copies or PDF files, but in a special format that computers can easily read and process.

Instead of sending a PDF by email, the invoice is shared electronically between the seller and the buyer in a secure format like XML. This makes the process faster, more accurate, and fully compliant with the UAE’s Federal Tax Authority (FTA) rules.

With e-invoicing:

E-invoicing helps your business work faster, smarter, and stay compliant with UAE tax laws. Here’s why it’s a good idea:

💸 Faster payments – Get paid quicker with instant digital invoices.

💼 Lower costs – No need to print or manually enter data.

✅ Fewer errors – Automated invoices reduce mistakes.

⚙️ Saves time – Frees up your team for other tasks.

🔒 More secure – Digital invoices are safe and trackable.

📊 Tax compliant – Meets all FTA e-invoicing requirements.

🔗 Easy to connect – Works with your existing accounting software.

🌱 Eco-friendly – Reduces paper waste.

In the UAE, e-invoicing is becoming a requirement for all VAT-registered businesses, not just large companies or those working with the government.

Whether you run a small shop, a service business, or a growing company, e-invoicing helps you:

Even if it’s not mandatory for your business yet, switching early to e-invoicing can help you work smarter and avoid penalties later.

E-invoicing is a digital way of creating and sending invoices—no paper, no printing, and no manual data entry. Here’s how it works step by step:

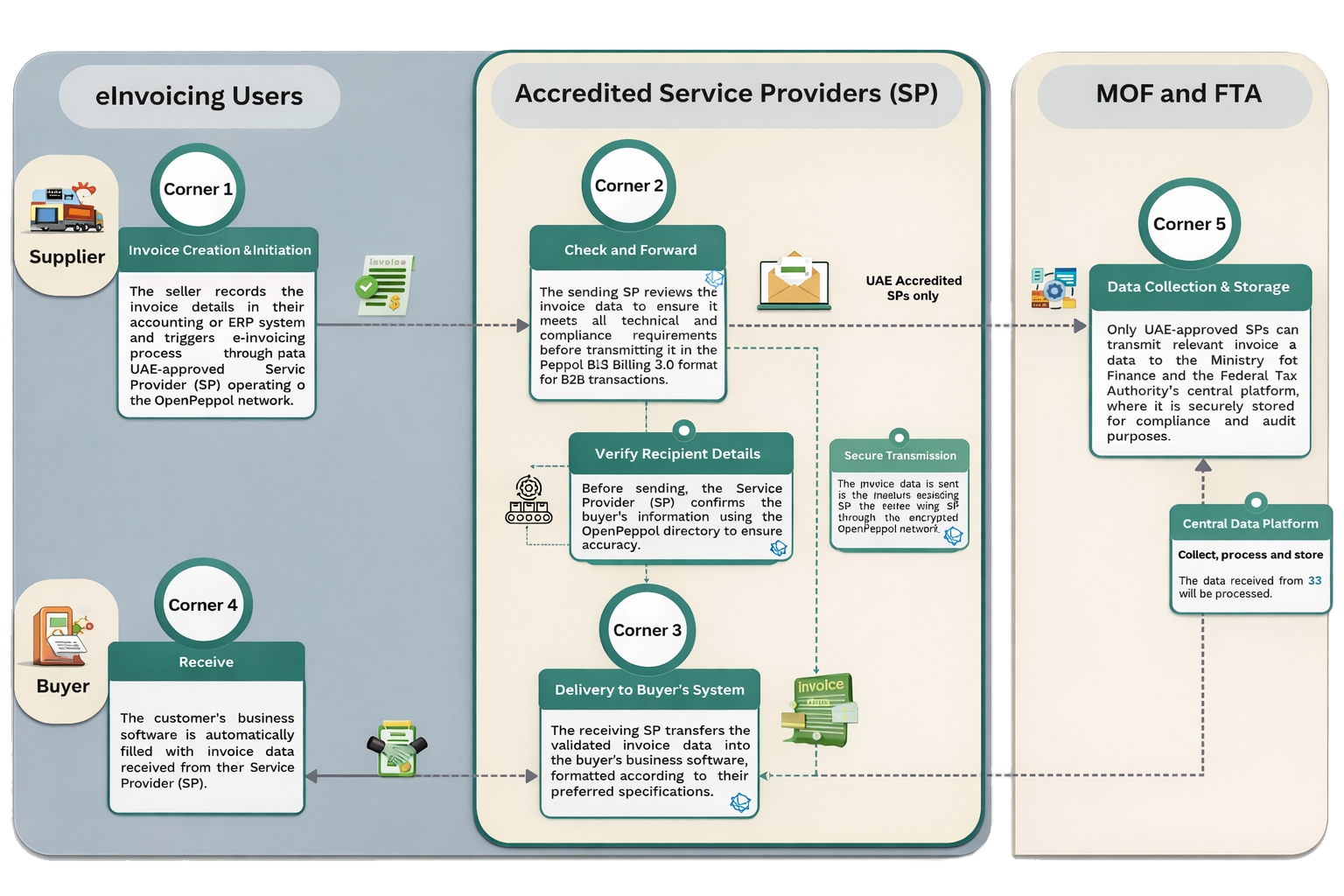

PEPPOL stands for Pan European Public Procurement Online. It’s a global network that lets businesses send and receive e-invoices in a standard and secure way. In the UAE, PEPPOL is used to make invoicing faster, reduce errors, and help companies easily connect with government systems and international partners.

An Accredited Service Provider is a company officially approved by the UAE government to offer e-invoicing services. These providers meet all the technical and security standards needed to help businesses generate, send, and receive e-invoices. Using an accredited provider ensures your invoicing process is reliable, secure, and fully compliant with UAE regulations.

If your business doesn’t comply with e-invoicing requirements, you could face penalties, delays in VAT refunds, or problems during tax audits. It’s best to get ready early by using the right system so you can avoid fines and stay fully compliant with the UAE tax laws.

No, you can’t create e-invoices manually or with tools like Word or Excel. In the UAE, e-invoices must be created using approved software that follows the FTA’s technical and security standards. This ensures your invoices are valid, secure, and accepted by the tax authorities.

In the UAE, e-invoices are created in a special digital format called XML (UBL 2.1). This format allows computers and the Federal Tax Authority (FTA) to easily read, process, and verify the invoice details. It’s not a PDF or Word file—it’s a structured file made for automated systems.

Yes, the MoF will regularly monitor and audit all Accredited Service Providers to make sure they are following the required rules and standards. This helps ensure that businesses using these providers stay secure and fully compliant with UAE regulations.